Introducing The Business of Big & Tall, a limited series taking a look at the cost of making clothing for plus size people. We’re kicking things off with a look at a controversial issue for customers and businesses alike: The Fat Tax.

Paying taxes is a part of life that most of us are used to. You know the old saying about death and taxes; both are certain. There’s another premium that bigger people have to pay, called the fat tax. In essence, the fat tax is an extra charge added to products that are available in an extended size.

You’ve undoubtedly experienced the fat tax before. Here are a few examples of it out in the wild:

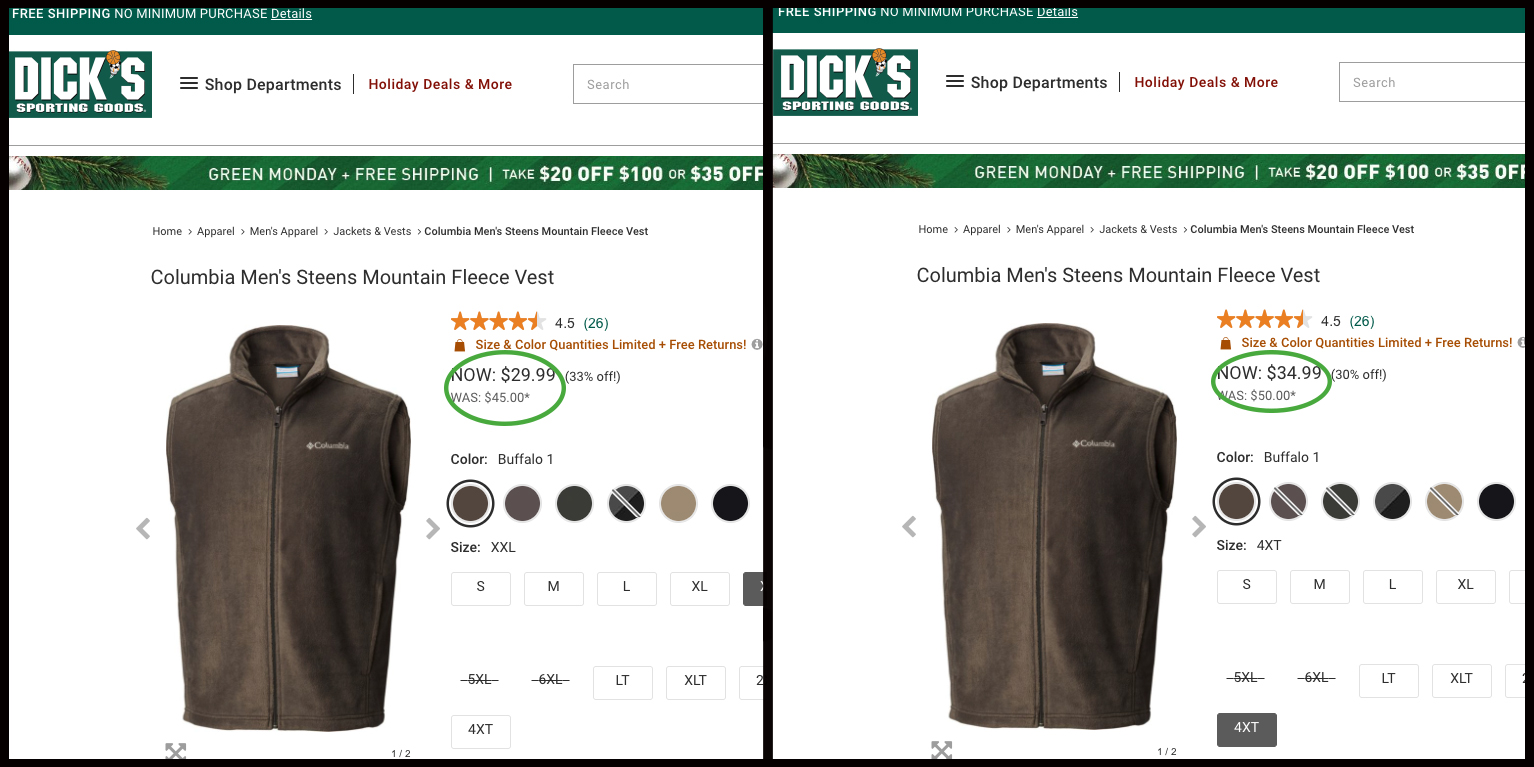

The XXL version of this item is less expensive

This Columbia Sportswear vest from Dick’s Sporting Goods retails for $29.99 in size XXL, and $34.99 in 4XT. Another example of the fat tax at work is seen in this long-sleeve t-shirt from Sears:

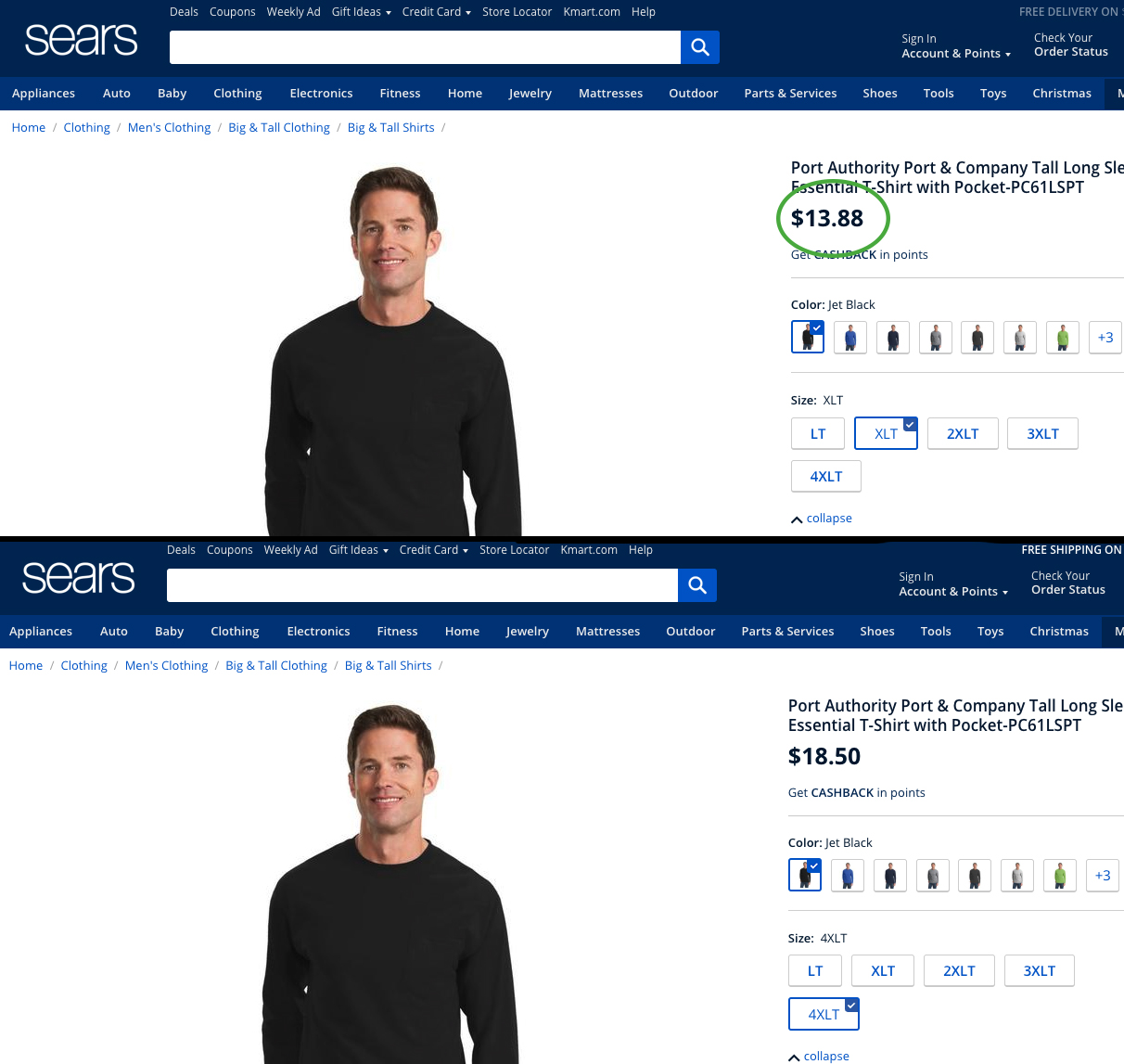

Note the price difference between the XLT & 4XLT

This shirt retails for $13.88 in an XLT, while the same shirt in a 4XLT increases to $18.50.

Some people argue that it is well within a manufacturer’s rights to charge more for larger garments. More fabric costs more money to produce. Does it really cost $5 more to make that 4X vest than it does to make the 2X version? If so, why don’t smaller sizes cost less? There’s no price difference between a small and a large, even though the large garment requires more fabric. Is this economics at play, or discrimination?

There’s still that small collective [within the industry] that are stuck in their ways and don’t understand how the retail industry is changing. They have the bigger platforms, and they’re able to still call the shots.

We decided to ask a few people in the industry for their take on the fat tax. Brandon Kyle Collection designer and creator Brandon Coates gave us his assessment:

“It’s kind of a double-edged sword in that [making extended size clothing] does require more fabric, but companies don’t have to charge the customer more. What’s happening is that a lot of retailers have been trying to discourage bigger people from being plus size. Here we are in 2019, and it’s still taboo. There’s still that small collective [within the industry] that are stuck in their ways and don’t understand how the retail industry is changing. They have the bigger platforms, and they’re able to still call the shots.”

We spoke with a rep from a major international retailer who was willing to share thoughts anonymously. This person said that in some cases, a premium on extended size clothing comes with a valid reason:

“Making a different silhouette can cost more. If you’re paying the tax, it’s probably because the silhouette is specifically made for bigger bodies. It costs money to create those [updated] designs. It really comes down to whether a brand wants to eat that cost.”

To many observers, the fat tax seems like a targeted effort to make plus size people pay more for their existence. Others say the tax is a way to pass along the cost of creating quality extended size clothing. After some investigation, the answer seems to be a mix of the two. Some companies are indeed putting in the effort to make clothes that fit, while others are simply up-sizing existing designs and charging a premium.

Another problem we see here is that other similar products don’t charge a premium in the same way. A pair of size 9 boots cost the same as a size 11, even though it takes more materials to make the larger shoe.

The customer-focused solution to the problem would be for manufacturers and retailers to eat the fee, instead of passing it along to customers. Treating plus size people as “other” only shows a brand’s tone-deafness. If cost is an issue, consider raising the price across the board – this avoids the issue altogether.

What do you think about the fat tax? Tell us in the comments or on your favorite social network.